Open Wealth: Unlocking transparent and efficient wealth management.

Open Banking has led to a paradigm shift in the financial sector. Digitalization and the demand for personalized financial solutions have changed our perspective and expectations regarding financial services. But what about the topics of wealth, wealth accumulation, and wealth management? The term “Open Wealth” is not new. But where exactly are we with this? Does Open Wealth have the potential to revolutionize wealth management in the same way that Open Banking has revolutionized everyday finance?

What is Open Wealth?

Open Wealth is like a door, opening up the world of finance to everyone. It’s about making financial services and data accessible to all parties, not just large banks. The Open Wealth concept is closely related to Open Banking but has a different focus and objective. Open Banking primarily focuses on payments and account information, giving individuals more control over their financial data. It also allows third-party providers (such as fintechs) to access this data and offer innovative services. Open Wealth, on the other hand, concentrates on wealth management and investment products. The goal is to democratize wealth management and create new, more efficient ways to manage assets. In simple terms: Open Banking opens the door to banking data; Open Wealth opens the door to investments.

The current state of wealth management is characterized by high costs, slow processes, and a lack of transparency

To fully explain the potential of Open Wealth, I need to provide some context. Progress can only be recognized when you know where you stand. Traditional wealth management, often offered by family offices or independent asset managers, has been and continues to be a personal and exclusive service. The relationship between family offices and asset managers and banks has often been close. Asset managers rely on the product offerings of banks to put together individual portfolios for their clients. In addition, the way family offices and the like work is characterized by intensive customer relationships, individual investment strategies, and manual processes. This in turn causes high costs, slow processes, and a lack of transparency.

Digitalization is democratizing wealth management

The digital transformation has revolutionized the wealth management industry, creating numerous opportunities and giving rise to innovative business models. Digital platforms like Trade Republic, Smartbroker+, growney, Scalable Capital, and Whitebox have made investing more accessible and affordable. These platforms automate investment management, providing personalized portfolios tailored to individual risk profiles. By automating tasks like rebalancing, they reduce administrative burden and offer a cost-effective alternative to traditional wealth management, especially for smaller portfolios. Moreover, digital platforms allow investors to monitor their portfolios in real time, access market data, and receive personalized insights. The combination of technology, automation, and personalized services has made wealth management more efficient and accessible to a wider range of investors.

- Increased cost efficiency: Through automation and digitalization, processes can be made more efficient and costs reduced.

- Increased transparency: Clients have a better overview of their investments and can transparently track the performance of their portfolios.

- Increased accessibility: Wealth management services are becoming more affordable for a wider range of clients.

- Data-driven personalization: Through the analysis of big data, we can create investment recommendations tailored to individual needs.

Next Step: Enabling Open Wealth with standardized APIs

As with Open Banking, Open Wealth showcases the power of open interfaces (APIs). These enable banks and (digital) asset managers to connect their systems, allowing for the exchange of data and functionalities across different systems. Think of APIs as bridges between banks, asset managers, and other financial service providers. Or in other words: APIs enable the integration of financial data from various sources, such as bank accounts, portfolios, and market data. This creates a comprehensive overview of a customer’s finances. Interfaces enable the automation of many processes: such as the transfer of data, the execution of transactions, or the creation of reports. Furthermore, APIs promote an open financial world where consumers have more control over their data and can compare providers. Sounds good, right? Unfortunately, the current connection between custodian banks and portfolio management systems or external asset managers is often still proprietary. With a one-time data exchange per day (end-of-day) and manual process steps. This leads to a higher error rate and additional costs for maintaining the various interfaces. Standardized interfaces in wealth management are therefore desirable and bring benefits to all parties involved.

The API Custodians: OpenWealth Association

The good news is that such an API for wealth management has already been developed. The driving force behind it is the Swiss OpenWealth Association, a consortium of banks, asset managers, and technology companies. Their goal is to create a business-oriented, widely accepted standard based on known industry standards. This standard aims to promote interoperability between different systems and accelerate the development of innovative financial services. The relevance of the OpenWealth Association’s API standard to the upcoming EU Regulation on Access to Financial Data (FiDA) demonstrates how close they are to achieving their goal: Their API is on the verge of becoming an officially recognized FiDA schema. The adoption of the EU FiDA Regulation, proposed by the European Commission in June 2023, is expected by the end of this year or early 2025. However, even after the adoption of FiDA, it will take some time for all market participants to implement the new standard.

wealthAPI Blog

FiDA as an Opportunity: How Data-Driven Compliance Strengthens Financial Institutions

Since the publication of the European Commission's 2026 work program at the latest, FiDA has once…

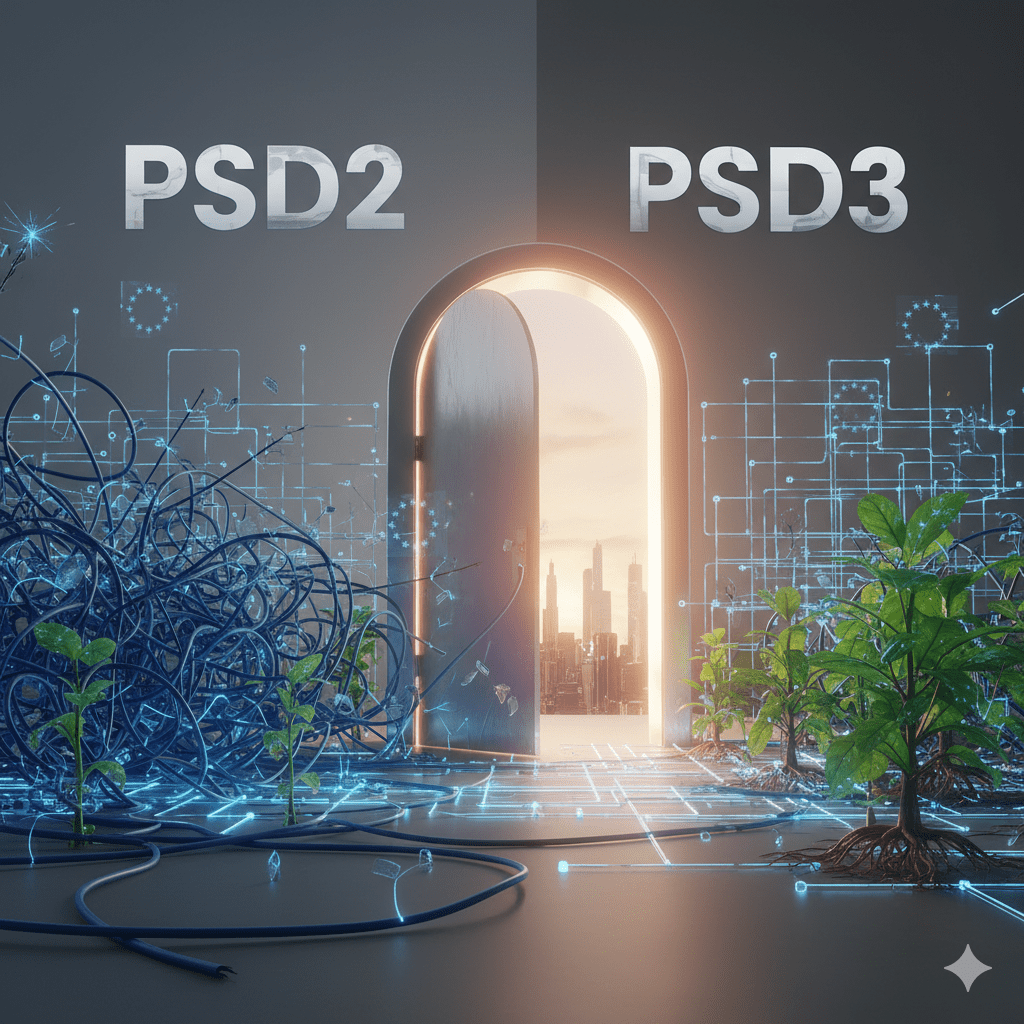

From PSD2 to PSD3: Europe’s last chance to make Open Banking a success?

When the second Payment Services Directive (PSD2) was introduced in 2018, it promised a revolution…

Susanne Krehl joins wealthAPI management team as Chief Growth Officer

Berlin, 18.08.2025 - wealthAPI GmbH, a leading German provider of wealth management interfaces, is…