wealthAPI Feature: Cashflow Analyzer

Personal finances at a glance

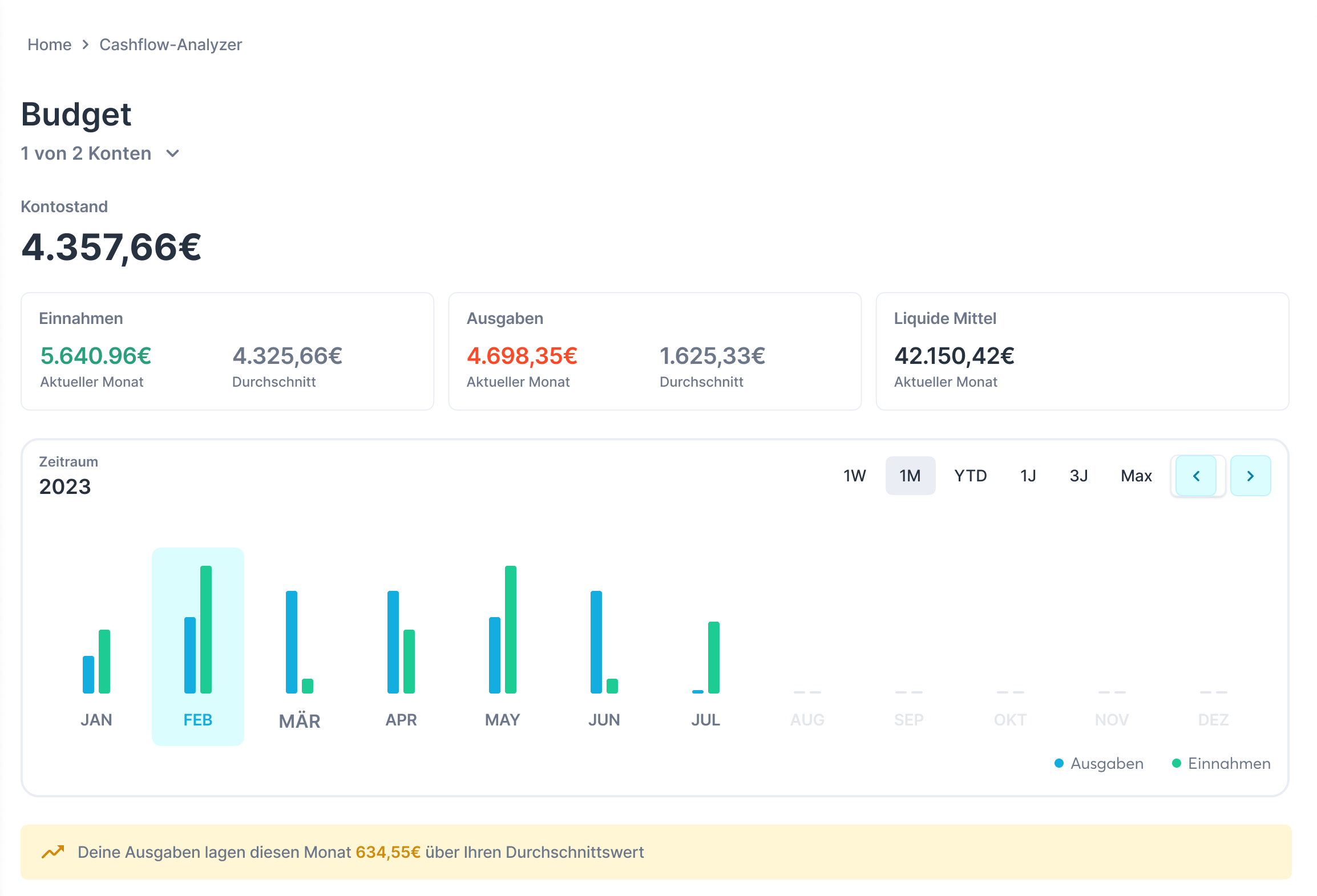

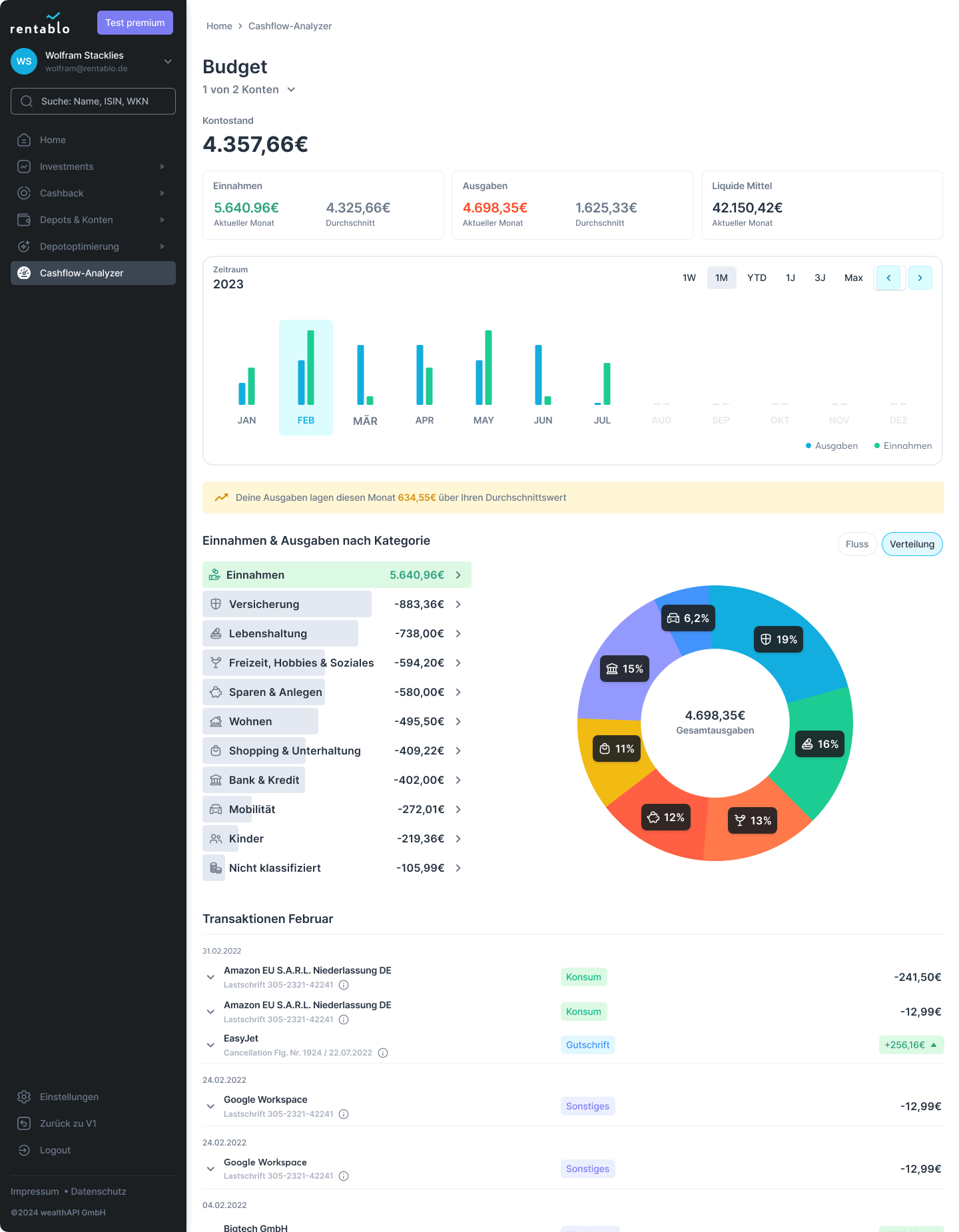

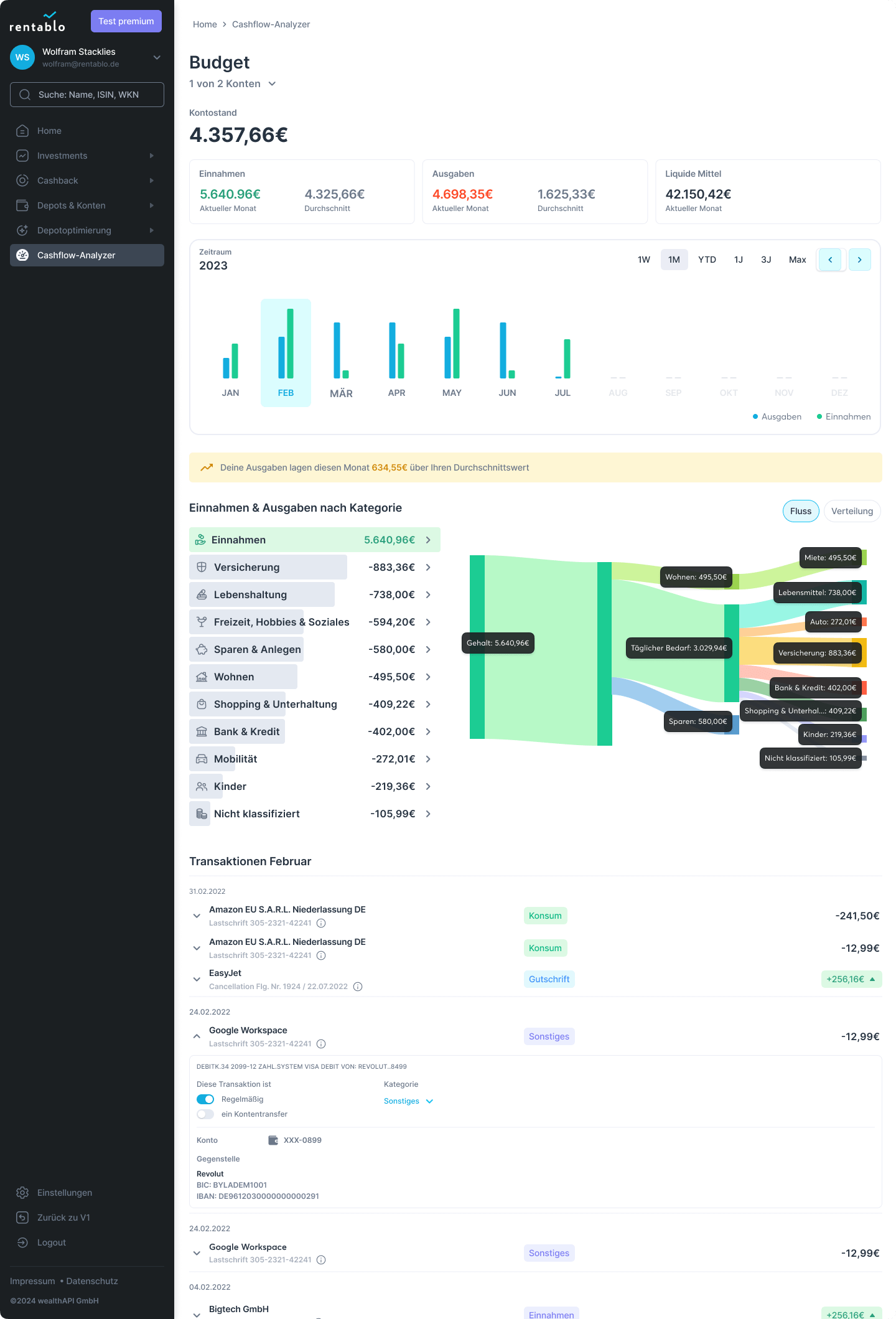

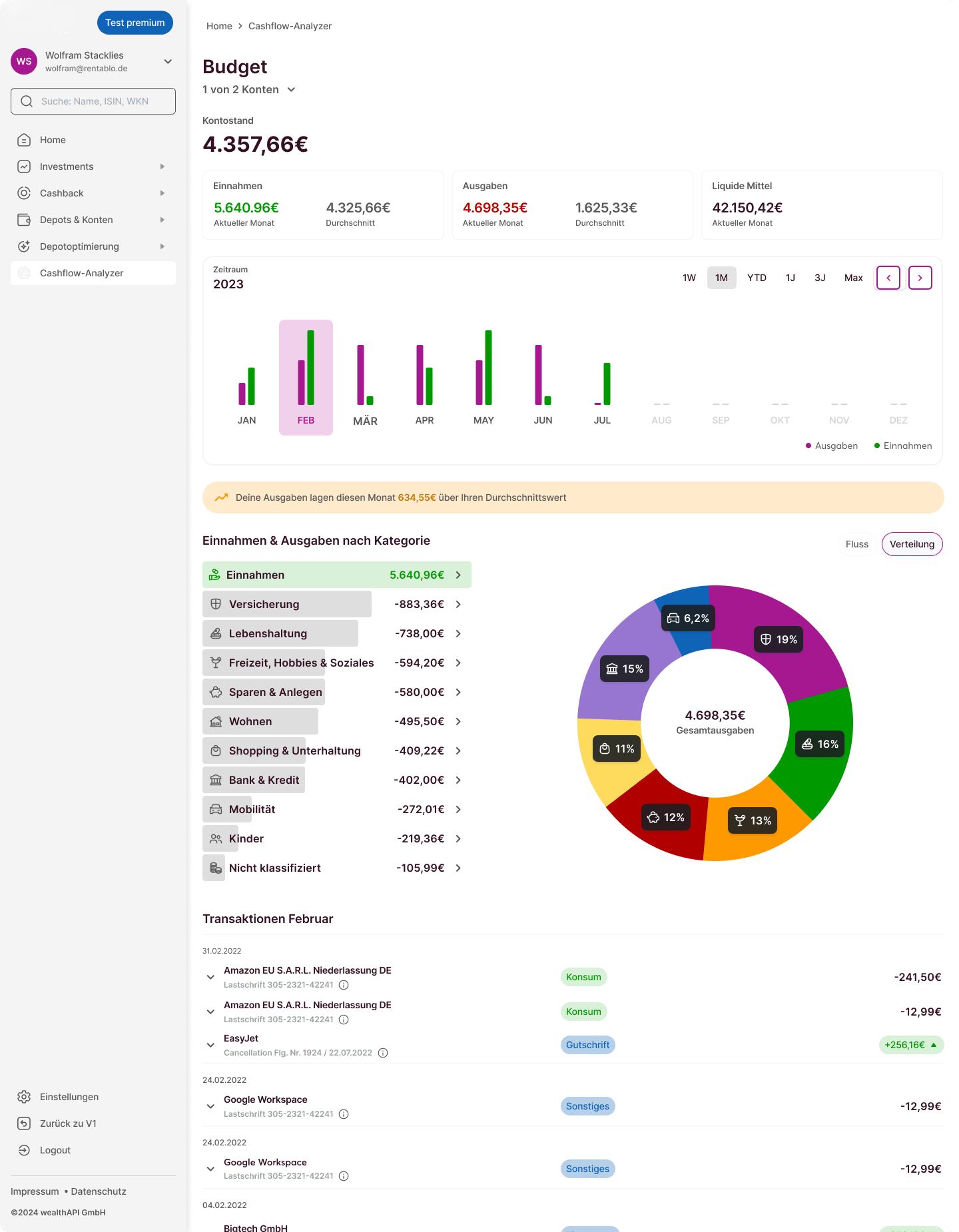

Most people don’t know exactly what they can afford. With our Cashflow Analyzer, your customers get an overview of all income and expenditure and know their available liquid funds at all times.

The Cashflow Analyzer in detail

Functionalities

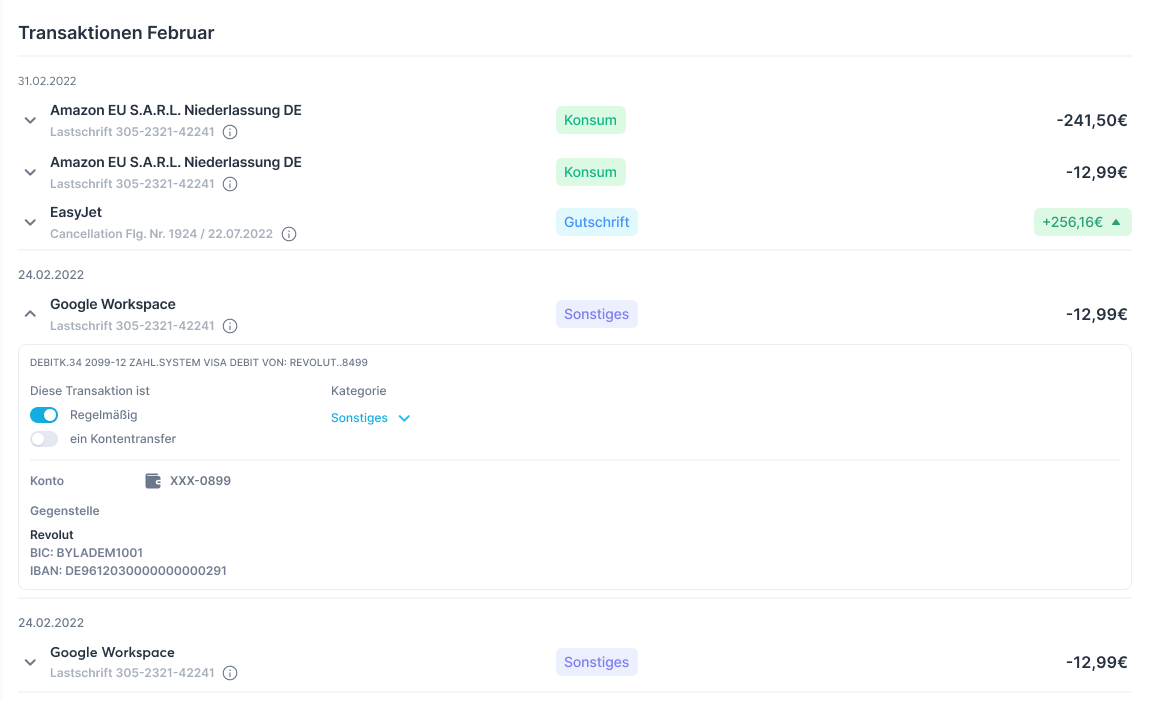

- Cash flow analysis reliably recognizes and distinguishes between regular and irregular transactions.

- Transactions that occur frequently but are not regular, are reliably ignored.

- Elimination of statistical outliers such as large transactions that do not reflect regular spending behavior

- Adjustment of transfers between accounts or from the purchase/sale of portfolio components

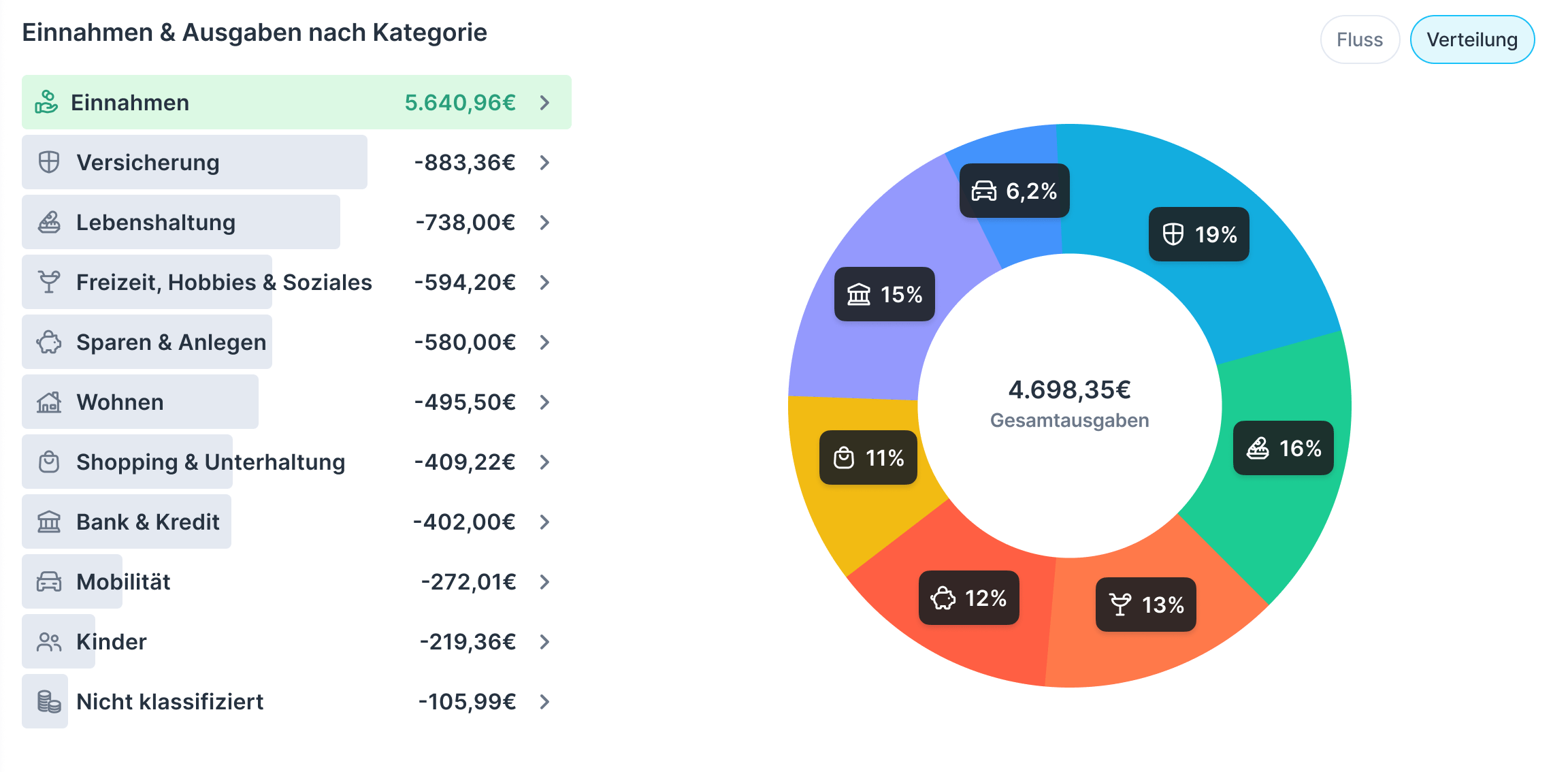

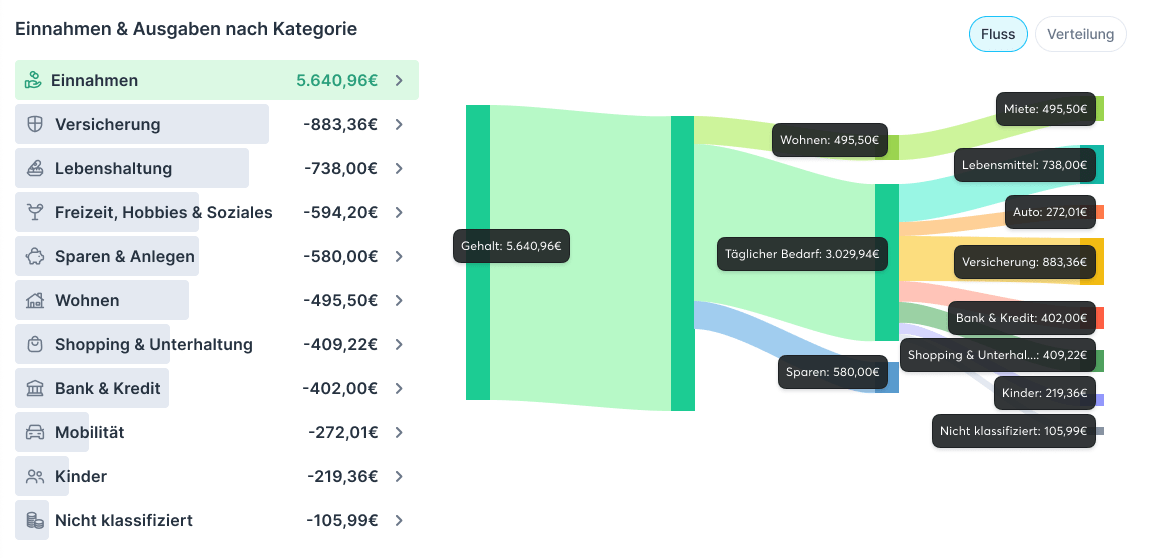

- Division of transactions into categories for efficient spend analysis and control

- View of the development of expenses & income and cash and cash equivalents in the current year (by month, quarter, individual period)

- Pie chart or flow chart (Sankey) view

- Warning notice for above-average expenditure

- Historical import possible, depending on the customer’s bank (usually 2 years)

Users are on track with their finances at all times

Number-based analysis of the financial situation

Data security

The protection of your customer data is our top priority. As a regulated account information service, we work in accordance with German banking security and data protection standards.

Note for developers

Simple integration of the Cashflow Analyzer feature into your systems via our wealthAPI

Do you already have a wealthAPI product integrated on your platform? Then you can also seamlessly integrate the Cashflow Analyzer into your existing systems. Further technical details can be found in our documentation.

Ready for an offer?Then contact our sales team directly.

After submitting this contact form, our sales team will contact you as soon as possible and send you an offer presentation by email.