wealthAPI Data

No data. No decisions

FiDA wealth data for informed decisions: Our APIs are the interface to a new generation of portfolio analysis solutions, enabling seamless integration into your existing systems.

Wealth Data According to the Financial Data Access Regulation (FiDA)

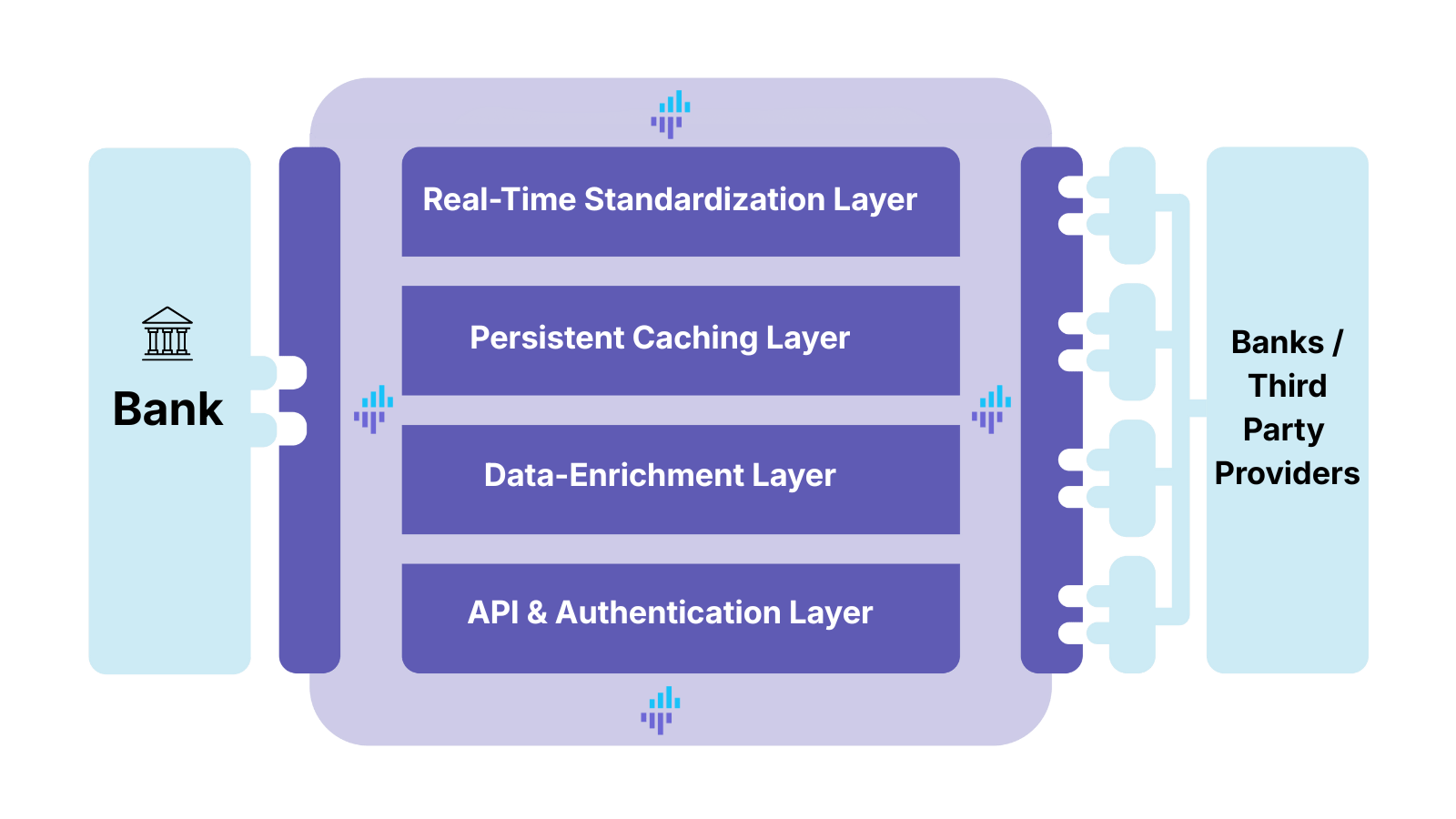

We help your institution become ‘FIDA-ready.’ In the future, you will be required to provide financial data in accordance with the Financial Data Access Regulation (FiDA). wealthAPI possesses years of experience in the design and creation of interfaces for asset data with our smart…

...wealthAPI FiDA Middleware - API's

A ready-made solution to enable your FiDA compliance

Extensive API experience

We possess many years of experience in the establishment (or building) of regulatorily compliant financial data interfaces.

Specialists in Data Processing

We enrich internal bank data with external information, thereby significantly increasing its value.

Experience with Monetization

Thanks to our experience in product development, we can efficiently utilize the regulatory framework of FiDA.

Practical Experience

We know which data is utilized and in what manner. Customer centricity is a key factor for our success.

Understanding customers - but the right way

In-depth financial data

Elevate your customer insights with comprehensive data, encompassing not only the PSD2 framework but also all relevant financial information. We are the industry leader in transaction data processing.

Payment Accounts (PSD2)

At the most basic level, our APIs can integrate and represent all your customers' payment accounts as defined by PSD2.

current accounts credit card accounts instant access savings accounts

Beyond PSD2

Beyond the PSD2 framework, we can also integrate a comprehensive range of additional customer financial data.

securities (multidepot, multibrokerage) crypto p2p lending Holdings real estate and other tangible assets such as precious metals, watches, art, and vintage cars home savings and loan data tax data insurance data

Our approach to financial data processing

We enhance the financial data obtained via our brokerage APIs through comprehensive analysis. This involves performance metrics, portfolio segmentation based on shared indicators, and projections of future dividend payouts.

Data Import

Typically, a user imports their assets via one of our brokerage APIs.

Data Aggregation

We remove artifacts, add missing data, and standardize the data.

Data Refinement

We enhance the data quality by integrating fundamental data, historical data, ESG criteria...

Data Analysis

Once the data is ready, we can analyze it according to our requirements.

Consistent data management

Your customers demand consistent data across all solutions.

Therefore, we offer a “bring your own data” approach for various data classes. This means you have the option to easily integrate your own data and data sources into our system using an API. This provides flexibility and control over the data you utilize within our platform, allowing you to leverage your existing information and connect it seamlessly with our services through a straightforward Application Programming Interface.

Your data will be clearly separated and visible only to your users!

Quotes

Dividend & Master Data

Asset Allocation

wealthAPI asset analysis tools

Learn how processed financial data can empower your customers

Beyond providing API access to your customers’ financial data, we deliver a comprehensive suite of tools designed for asset analysis and optimization.

Cashflow analyzer

Our wealthAPI budget planner tool empowers users to maintain constant visibility into their income, expenses, and liquid assets.

Dividend Planner

The dividend planner not only presents historical dividend data but also forecasts potential future dividend income.

Contract Analytics

By analyzing contracts, based on machine learning, we can identify recurring expenses and improve contract management.

Product Recommendations

MVP: By merging user-centric data with financial mathematics, we ensure the delivery of the right product at the right time.

Data Security

Protecting your customer data is our top priority. As a BaFin-regulated Account Information Service, we operate in accordance with German banking security and data protection standards. Our internal processes are continuously checked for compliance and security.

Well-established compliance

Maximum security standards

Hosting in Germany

Customers

These companies are already working with wealthAPI

Our innovative solutions have convinced numerous clients from the financial industry since 2023. Whether it’s a financial platform, influencer, online platform, bank, publishing house, asset manager, or family office, our technology is used wherever efficient and flexible solutions are required.

Ready for an offer?

Then contact our sales team directly.

After submitting this contact form, our sales team will contact you as soon as possible and send you an offer presentation by email.